U.S. state cigarette and e-cigarette taxes

State and local governments tax a variety of tobacco products, including cigarettes, chewing tobacco, and smokeless tobacco (often referred to as “other tobacco products”), as well as e-cigarette products. Different tobacco products are taxed in different ways: cigarettes are taxed by the pack, other tobacco products are usually taxed as a percentage of the price, and e-cigarette products are taxed per ounce of e-cigarette liquid or as a percentage of the price (depending on the product and state) .

All tobacco-related taxes are levied on the manufacturer or seller of the product during wholesale transactions, not on the retailer. However, it is assumed that the tax is included in the final purchase price and thus passed on to the consumer.

These taxes are sometimes called corrective taxes or “sin taxes” because, unlike general sales taxes, they are used to discourage tobacco (or vaping product) use to the extent that the choice to use tobacco is detrimental to both the user and others. There are costs (such as increased health care costs). State and local governments taxed alcohol and began taxing marijuana and soda in a similar manner.

● How much revenue do state and local governments receive from cigarette and e-cigarette taxes?

In 2020, state and local governments received $19 billion in revenue from tobacco taxes, accounting for 0.5% of state and local general revenue. In 2020, state tax revenue accounted for 98% of tobacco tax revenue.

The Census Bureau does not break out tax revenue from different tobacco products, but the vast majority of tobacco tax revenue comes from cigarette taxes. For example, a report from the North Carolina Department of Revenue found that cigarette tax revenue accounted for 81% of the state’s tobacco-related tax revenue in fiscal year 2020.

Although the popularity of e-cigarettes has increased in recent years, the resulting tax revenue is still relatively small compared to taxes on cigarettes. North Carolina has taxed e-cigarette products since 2015. In fiscal year 2020, e-cigarette product tax revenue reached $5 million, accounting for 2% of the state’s tobacco-related revenue. Likewise, the National Conference of State Legislatures found that annual revenue estimates from new state e-cigarette taxes enacted in 2019 and 2020 ranged from $1 million in Vermont to $16 million in Kentucky.

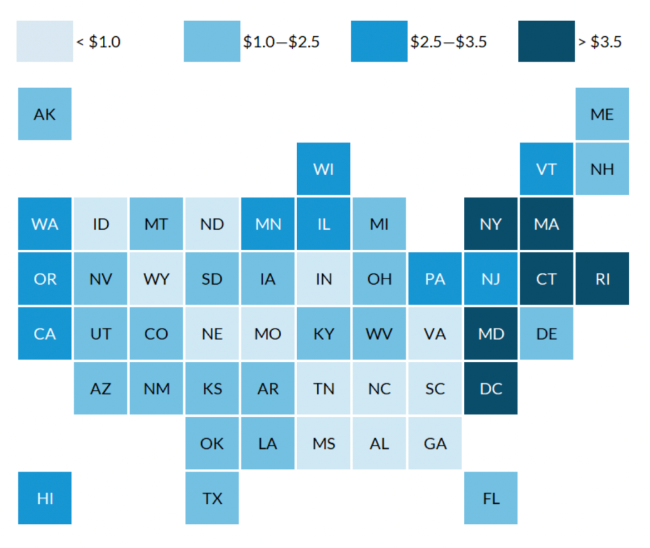

How much do cigarette tax rates vary from state to state?

All states and the District of Columbia tax cigarettes, but the rates vary widely. Missouri has the lowest cigarette tax at just $0.17 per pack, followed by Georgia ($0.37), North Dakota ($0.44) and North Carolina ($0.45). The District of Columbia has the highest state tax rate at $4.50 per pack. Connecticut, New York and Rhode Island also have cigarette tax rates above $4 per pack.

Source: Federation of Tax Administrators (FTA), tax rates (as of January 1, 2023). Note: Rates do not include local taxes that counties and cities may impose on an additional pack of taxonomies. Florida prices include USD surcharge per package. Dealers pay an additional fulfillment and administration fee of 0.05 cents in Tennessee. The District of Columbia and Minnesota impose additional cigarette sales taxes.

However, when local taxes are included, consumers in some states pay higher taxes on cigarettes. For example, the state tax rate in Illinois is $2.98 per package, but when including taxes and fees imposed by the City of Chicago ($1.18) and Cook County ($3.00), consumers pay $7.16 per package.

A total of 10 states allow local governments to impose additional excise taxes on cigarettes: Alabama, Alaska, Colorado, Illinois, Missouri, New York, Ohio, Pennsylvania, Tennessee and Virginia. Local tax rates range from 1 cent per pack in parts of Alabama to $4.18 per pack (city tax plus county tax) in Chicago, Illinois. The cigarette tax in New York City is $1.50 per pack, which when added to the state tax works out to $5.85 per pack for consumers. Nearly 650 localities in these states impose cigarette taxes, according to the Campaign for Tobacco-Free Kids. In addition, San Francisco imposes a $1.25 “cigarette litter abatement fee” per pack of cigarettes, even though California cities cannot impose excise taxes on cigarettes.

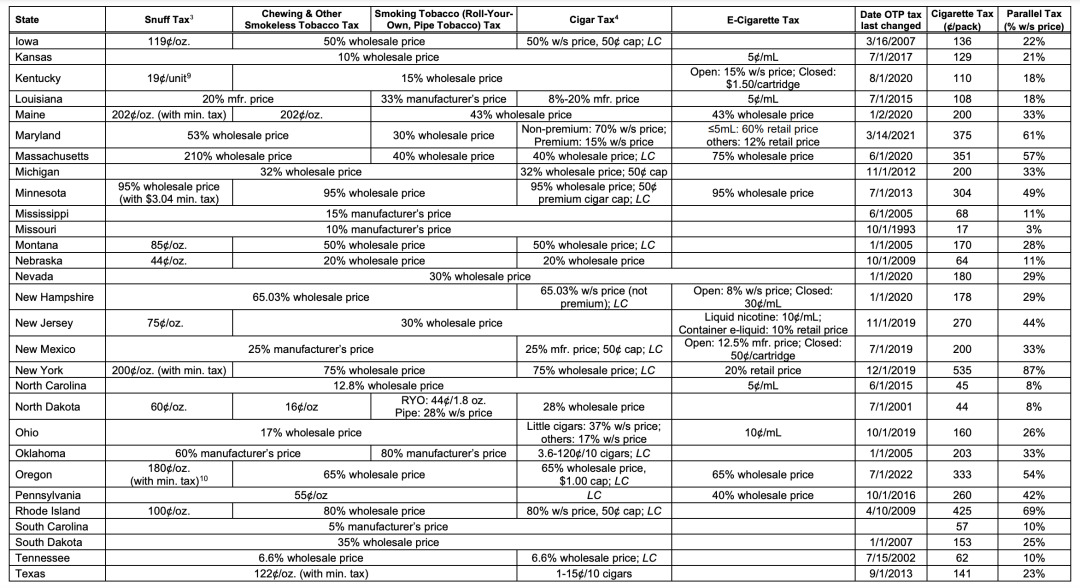

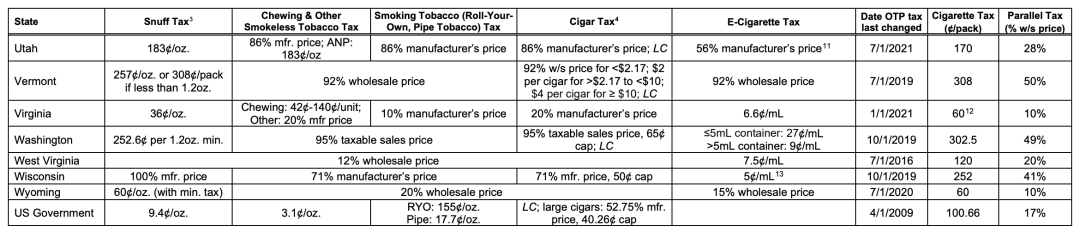

All states also tax non-cigarette tobacco products such as chewing tobacco. Most states tax “other tobacco products” as a percentage of the price, ranging from 5 percent of the manufacturer’s price in South Carolina to 95 percent of the wholesale price in Minnesota. However, some states impose per-ounce taxes on products such as snuff and chewing tobacco.

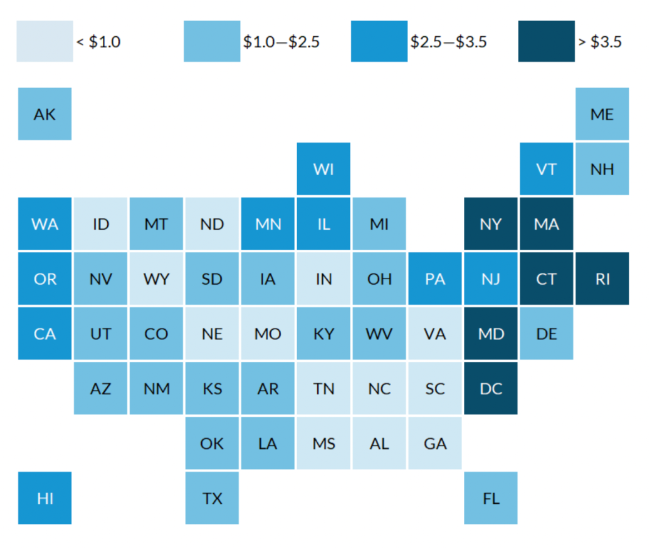

● How different are the e-cigarette tax rates among states?

Many states and localities have increased taxes on vaping products over the past few years. As of January 2023, 30 states and the District of Columbia have taxed vaping products. Additionally, Alaska and Nebraska have local taxes on e-cigarettes but no state taxes. Some states tax vaping products as a percentage of the price, some use a unit tax, and some use both.

Source: “State Excise Tax Rates for Non-Cigarette Tobacco Products” Campaign for Tobacco-Free Kids/Ann Boonn. January 2023 (accessed January 27, 2023). Note: Connecticut, Georgia, Indiana, Kentucky, New Hampshire, New Jersey, and New Mexico use price percentages and unit taxes on e-cigarette products.

Twenty states and the District of Columbia tax a percentage of the price, ranging from 7 percent in Georgia to 95 percent in Minnesota. Many of these states add e-cigarette products to the state’s definition of “other tobacco products,” making them eligible for the state’s existing OTP tax.

Sixteen states impose unit taxes on e-cigarette products. Most state taxes are based on the liquid that delivers nicotine to smokers. These rates range from 5 cents per milliliter (four states) to 40 cents per milliliter in Connecticut.

The sum of these two taxes is greater than the total number of states that tax vaping products because some states impose both taxes based on the type of vaping product. Specifically, some states impose a percentage-of-price tax on “open-back” e-cigarette products (where liquid is filled by the user) and a per-ml or per-carton tax on “closed-back” e-cigarette products, which are pre-filled with liquid for immediate use. products used. use. For example, Kentucky imposes a tax of $1.50 per box on “closed” products and 15% of the wholesale price on open products, and Connecticut imposes a 10% tax on open products in addition to a per-ml tax on closed products. Additionally, Maryland taxes “open” and “closed” products at different percentages of the price, with higher rates on e-cigarette liquids sold in containers smaller than 5 milliliters. Anti-vaping advocates argue that closed-end products, such as those marketed by JUUL Inc., target young people.

Summary of e-cigarette tax in the picture:

California: 56.32% wholesale price + 12.5% sales price

Colorado: Closed system: 40c/mL; Open: 10% w/s price

Delaware: 5 cents/mL

District of Columbia: 79% off wholesale price

Georgia: Closed system: 5 cents/mL;

Open and disposable items: 7% w/s price

Illinois: 15% off wholesale price

Indiana: Closed Systems: 15% w/s price; Open & Disposable: 15% of gross retail revenue

Summary of e-cigarette tax in the picture:

Kansas: 5 cents/mL

Louisiana: Open: 15% net, Closed: $1.50/box

Delaware: 5 cents/mL

Maine: 43% off wholesale price

Maryland: ≤5mL: 60% of retail price; others: 12% of retail price

Massachusetts: 75% off wholesale price

Minnesota: 95% wholesale price

New Hampshire: Open: 8% w/s price, Closed: 30 degrees/millimeter

New Jersey: Liquid nicotine: 10 cents/ml; containerized e-liquid: 10% of retail price

New Mexico: Open manufacturing financing rate 12.5% price; closed 50 cents/box

New York: 20% off retail price

North Carolina: 5 cents/mL

Ohio: 10 cents/mL

Oregon: 65% off wholesale price

Pennsylvania: 40% off wholesale price

Summary of e-cigarette tax in the picture:

Utah: 56% of manufacturer’s price

Vermont: 92% off wholesale price

Virginia: 6.6 cents/mL

Washington State: ≤5mL container: 27 cents/ml; >5mL container: 9 cents/ml

Wisconsin: 7.5 cents/mL

West Virginia: 5 cents/mL

Wyoming: 15% off wholesale price